David Muscott

LLOYDS ARCHIVE THEFT: TIME TO TELL THE TALE

My name may be known to readers who are philatelic collectors of British Commonwealth countries, but one of my hobbies is collecting old English provincial banknotes. To enhance my enjoyment of the hobby I joined the International Banknote Society in 1971, which has regular worldwide meetings; I am a member of the London chapter. This article first appeared in their Spring journal this year, but it seemed to me to be of likely interest to a wider audience and the Insider was an obvious choice.

Now aged 81, I have been in the stamp trade all of my working life. My training at the well-known auctioneer, Robson Lowe, was a tremendous experience. It taught me a lot about the detection of forgery and faking, and I have been a signatory on the David Brandon expert committee for over 40 years. After the passing of my father in 1974, I took over the stamp business that he set up in 1947 and it continues quietly today.

The first time I saw a provincial bank note was at Robson Lowe Ltd and it was from the Leith Bank. It belonged to Marcus Samuel, an intense researcher whose studies were published in the Essay Proof Journal. Marcus sold me the note for 10/- (50p) and he told me that hundreds of English banks had issued their own notes over about 220 years. My interest was aroused and I decided to find out more about these historic notes. The Leith note was exchanged via a dealer for a Honiton one and in early 1971 I joined the International Bank Note Society.

Living in Guildford, it was fairly easy for me to attend the monthly London IBNS meetings and I was able to buy a good selection of notes from the dealers of the day who also were members and attended these meetings. Occasionally I was asked to give short talks on my chosen subject and in 1975 I addressed the annual Banknote European Congress.

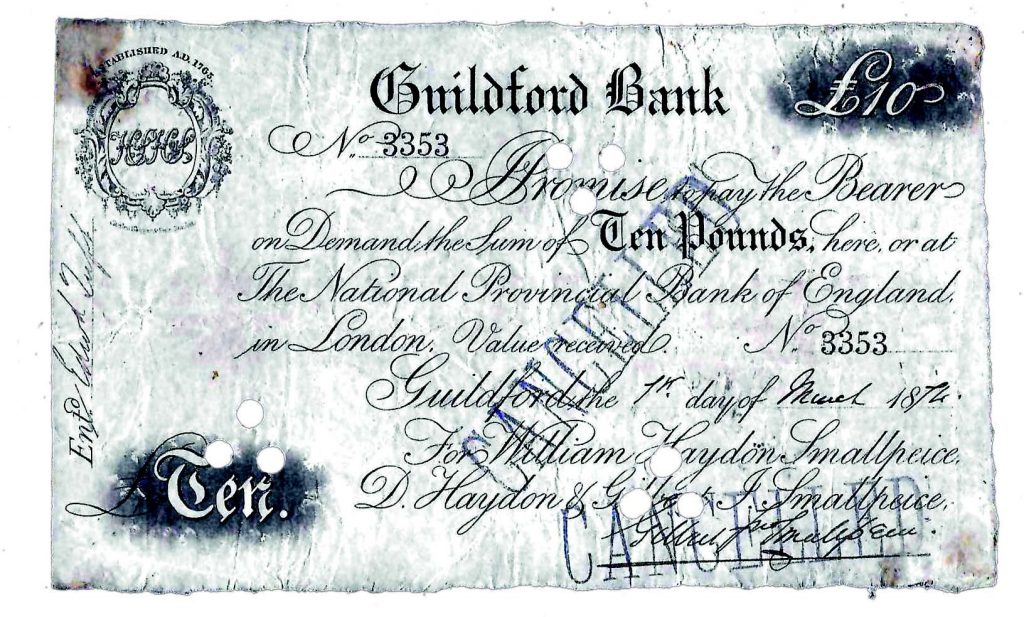

The story of the Lloyds theft starts for me in April 1973 when the Stanley Gibbons currency department offered to sell me a Guildford £10 note, numbered 3353. As Guildford and Godalming were my home towns, I was of course delighted and wanted to know more about the bank. At this time we had no catalogue and the only reference I could obtain was the list of old banks to be found in the back of the annual Bankers Almanac. Information in that book was limited and it was not until Geoffrey Grant published his excellent catalogue in 1977 that collectors had access to substantially more information and details on the banks and their notes.

Having purchased the note for the high (at that time) price of £25, I found out that Haydons bank in Guildford High Street had been taken over by Capital and Counties in 1883, and this large group had sold this and many other banks to Lloyds Bank in 1918. Today they continue trading as Lloyds TSB. So the little bank that opened in 1765 continues today. This is typical of the times but many of the other banks around the country fared less well. In 1793 over 100 banks were made bankrupt, mainly due to the lack of gold and concern over the war with France. Gold was a major problem and it was the lack of this commodity in 1825 that caused the demise of a further 80 banks, many of which were dependent on their London bankers.

The vast majority of notes available to collectors come from bankrupted banks. Very few are known from those banks that were taken over. Most of these takeovers occurred in the latter half of the 19th century and provincial bank numbers declined due to the major bank act of 1844 which severely curtailed the activities of the existing banks and prevented the formation of new ones. In 1800 several hundred banks existed but by 1900 only 32 survived. The last to close its doors was the Wellington Somerset Bank which was bought by Lloyds on 1st January 1921, bringing this long list of private or joint stock banks to a close.

In order to investigate the Haydons Bank in Guildford I phoned the ‘curator’ of Lloyds head office at 71 Lombard Street London and inquired if they would allow me to examine any banknotes they had from the Guildford and Godalming Banks. I was in for a treat! On 3rd April 1973 a clerk sat me down in a large office and brought three long boxes which contained hundreds of notes from the many banks that Lloyds had taken over. The clerk left me alone in the room and there were no cameras to watch me. As a professional philatelist I would not have accepted this situation, but as Lloyds were doing me a big favour I got on with examining the large quantity of notes. Time was short as I had to return to my work, but I made notes of the Godalming and Guildford Banks. Imagine my surprise when I found a Guildford £10 note numbered 3352, the previous number to the one I had recently bought. When I had finished, the clerk returned and I told him that I was delighted to see the archive and that they were of great interest to collectors who would gladly pay serious money to add them to their collections. I encouraged him to keep them safe, but I suspect my comments fell on deaf ears and that the bank looked upon these notes as simply old files and were quite unaware of their continued value.

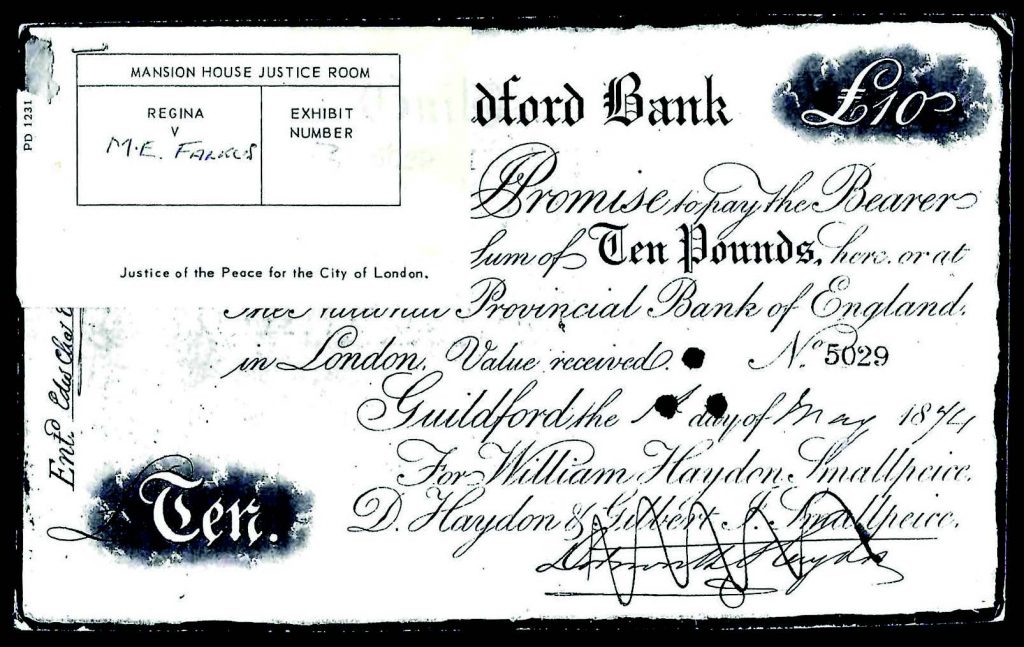

Apart from the banknotes, the Lloyd’s archive also had several cheques which I found of interest and I was permitted to borrow a few for photography. These helped with a talk I was due to give to the IBNS that May. I made two copies and gave one set to the Manager of Lloyds Bank in Guildford High Street.

The summer months were a less active time for my collection but by October I had bought another three Lloyds amalgamated notes. As the society had again asked me to speak on English provincials, I borrowed three notes from well- known and respected dealer David Keable. Yet again they were Lloyds notes and together with mine this meant that I had in hand seven Lloyds amalgamated notes. I did also have a rare note from the National Westminster Bank but none from Barclays or Midland Banks. When I gave my talk on 31st January 1974, I emphasised that I found this disproportionate rate of Lloyds notes to be suspicious. Later that evening there was a small club auction and two further Lloyds notes were offered. The following day Chris Stocker of Spink offered me another Guildford Haydon note, which I declined as it added nothing of importance to the one I already had in my collection. So now I was aware of the existence of 10 suspect notes and Spink told me chat another consignment had arrived and was awaiting pricing. These would be held for my first consideration, and I bought all five.

Now I could account for at least 15 Lloyds notes and I knew that other dealers must have more which had not been offered to me and had been bought by other collectors. My professional philatelic instincts were aroused and I smelt a very unwholesome rat, one that was waiting to be trapped!

It is of course quite natural for traders to keep their supplier’s name confidential and normally I would respect this, but there was growing suspicion and evidence that those notes might have come from a museum or official source and should not be on the market. Such things have happened in the stamp world so I decided that I would request the name of the seller from three of my trade suppliers. Spink and Keable had heard my comments at IBNS meetings but the third supplier decided, not to my surprise, that they would not co-operate with me. Money talks! My two helpful and sensible dealers both gave me the name: Malcolm Falkus. I had never heard his name before and knew that he certainly was not a member of the London chapter of the IBNS. The time had come when I felt it necessary to see if Lloyds archives were being sold, perhaps without their knowledge. I could think of no other possible source, so I told my dealer friends that I intended to contact the bank.

On the morning of 7th February 1974, I telephoned the bank and asked to speak to their chief inspector. He was not available the but the assistant inspector Mr Aldison took my call. I explained that I suspected some of their archives had been stolen and were being sold. That afternoon their chief inspector, Mr Coombes, called my office and took full details of the several notes from my collection. I asked him if he knew the name of Malcolm Falkus and he confirmed that he did indeed know that name. However, he refused to comment further.

The following day, 8th February, David Keable phoned to tell me that Falkus had contacted him and wished to bring yet further notes on that Sunday. As David lived in the Epsom area and there happened to be a train strike scheduled that day it seemed likely chat Falkus would be coming by car. Quite naturally David was concerned as to what action we should take and after a few seconds’ thought I realised that this was the ideal opportunity to prove that this man was selling these notes. I therefore suggested to David that a trap should be laid, providing I could arrange with Lloyds for an indemnity for any notes that David purchased on this occasion. Mr Aldison, the assistant inspector, agreed to my suggestion and I confirmed this to David. By this time I was considering the strong possibility that, if our suspicions were correct, this might easily become a matter for the police. To make things as watertight as possible I said to David that certain precautions must be made, namely that he should have his business partner Edith Salter present, payment should be made at least in part by cheque, and that the number plate of the car in which Falkus came should be noted. David agreed with these points but I wondered if enough items had been covered in the event of any case coming to court. Time to seek advice. Fortunately, I had a local friend with whom I played cricket and he lived close by. Richard was also a sergeant in the Guilford police force so I outlined my plans and asked if he could see any faults. After careful deliberation he confirmed that we had made sufficient arrangements and felt we should operate our plan. On hearing this David and I agreed that Falkus should be allowed to come on that Sunday and that David would phone me to advise what had been purchased.

Late on that Sunday afternoon David called and told me that Falkus had arrived with a friend, J Chapman, who had driven him as Falkus did not have a car. The number plate was recorded. In all there were eleven banknotes sold and a cheque of £200 was paid to Falkus. All the notes were, as usual, Lloyd’s amalgamations. I wrote down details of each note and to my amazement the last note was the Guildford £10 number 3352, the very note that had caught my attention in Lloyds archives a few months previously as it was the previous number to the note I had bought from Stanley Gibbons. Bingo!

Having proved to my satisfaction that these notes did indeed come from the Lloyds archives I phoned the inspectorate the following morning and awaited events. The bank decided to prosecute Falkus and a hearing was held in the Mansion House later in 1974. The purpose was for the crown to establish whether there was a case to answer so no jury was involved at that time. On the few times I have had to appear in court I am pleased to say that I have never been ‘in the dock’ and if you are not used to being in these strange surroundings, I can tell you that it is rather intimidating. Certainly Falkus was feeling the pressure. This was the first time that I had seen him and I noted that he was tall, slim and extremely nervous, showing continual signs of distress. Evidence was taken in much the same way as for a full trial and I was informed later that the judge had decided that there were sufficient grounds for the crown to make a prosecution.

As for me, I had always realised that I would lose my lovely Lloyd’s notes if it was proven that they had been stolen so I had very mixed feelings at that time. I and other collectors would have to return our purchases to the vendors and should then have our money returned. The traders would not be so ‘fortunate’ as they would need to return the notes to the bank and would be out of pocket. However, it had to be done and better sooner than later.

At this stage the bank felt able to give me more information concerning Falkus. The police obtained a warrant to search his home and found a stash of notes from a Welsh bank that Falkus said he had brought home to study. As they were all unissued and simply numbered in sequence it is hard to see what study could emerge. He was said to have Communist views, although we don’t know if he had any party affiliation. He lived with a woman but I am unsure whether or not they were married. She was a bit unusual too and spent much of her time spinning on an old-fashioned spinning wheel.

So how did Falkus obtain access to the Lloyds Banknotes? The answer lies in the history of the bank.

Professor RS Sayers wrote a superb history of Lloyds, documenting almost everything one could imagine up to the year 1939, and a copy sits in my library now.

In the early 1970s the Lloyds board wanted an update since so much had happened since 1939, so Professor Sayers was approached to see if he could help. He declined the offer due to old age but said he knew a man who might be able to help – a brilliant young colleague of his from the London School of Economics, who had recently graduated with a first-class degree. With such high recommendation and qualification, the bank must have felt safe in asking Professor Malcolm Edward Falkus to take on the task of updating the history of their bank. Falkus was subsequently introduced and given an office with full access to all of the archive records. The stage was set.

Legal wheels are slow today and so they were in the 1970s, thus the date set for the trial was in January of 1976, held at the Central Criminal Court in London, better known as the Old Bailey. The first witness to be called was myself and the prosecutor walked me through my testimony as it had obviously been agreed, and it was all fairly straight forward. The defending counsel had no questions for me. Thus, I was out of there in a half hour and quickly on my way back to my office in Godalming.

Much as I would have liked to stay and see the rest of the trial, I knew that was impractical. It had only been two years since I had taken over the stamp business after the death of my father, and I needed to return to my duties that day.

A week or so passed when I phoned Mr Coombs, the Lloyds inspector, to inquire what had happened at the trial. I must admit that I was expecting a guilty verdict but I was mistaken. Falkus told the court that he had bought the banknotes from a man in a pub but didn’t know his name or any contact details. He was acquitted. Frankly I thought that sort of comment would be laughed out of court – wrong again. Looking at the facts as I knew them I know how I would have conducted the defence if I had been the counsel. Lloyds archives had zero security and it is quite possible that many employees could have had access if they had cared to do so. Put across with force this may well have been the plausible reason a not guilty verdict was given. On the plus side, I could keep my banknotes and for that I was delighted.

It is worth noting that after Falkus was charged with theft in early 1974 the supply of Lloyds notes immediately ceased. We may never know how exactly many were taken but judging by the number that I have seen in other collections, auction sales and dealers stocks, my guess would be that around 250 to 300 were removed from the archive. An average sum paid to Falkus by the trade in 1973 was £10 so we may calculate that he could have benefitted to the tune of about £3,000, always assuming that it was he who purloined them!

Having walked free, Falkus continued to teach economics at the London School until 1988. During this time he wrote five studious books on economics regarding Russia, Britain and North Thames Gas. In 1988 he moved to Australia where he succeeded Ron Neal as professor of economic history at the University of New England, in Armidale, New South Wales. He became the first director of the UNE’s Asia Centre and was general editor of a two book series Studies in the Economics of East and South Asia. Eventually he wrote or edited 10 books and numerous articles on the subject of economics, and was chairman of his department.

He retired in 2000 and then lived in Thailand where he compiled a Thai-Khmer dictionary, also a series of labour law manuals for Cambodia. He was living in Patcya, Thailand in 2008 when he was arrested and charged with paying young boys for sex. Bail was set at 200,000 Baht, roughly £4,000 at that time. He denied all charges but escaped to Cambodia, avoiding prosecution, returning to live in Norwich where he remained until his death in 2017.

Falkus was clearly a complicated genius who earned fame and fortune but was probably guilty of theft and sexual misconduct. Since he was never convicted, perhaps final judgement should be left to him.

On 28th November 2017, at his home in Norwich, Malcolm Edward Falkus hanged himself by the neck.