Dear Friends and Collectors,

As every summer in August, I am writing these few words from my holiday house in France. Being away from the office is a good place to reflect on our business activity and hobbies. It is also a time when heat waves are affecting the northern hemisphere, leading to massive forest fires everywhere. Those of you who know me well, know my love for nature and especially trees. Those wildfires, 95% of human origin, sadden me particularly.

This year France had its biggest loss of forested areas due to wildfires since 1949, and I am equally upset by the inability of our leaders to be prepared for an occurrence which is becoming more and more regular. After every disaster Canadair planes are promised, and the following summer we are still under-equipped to deal with these fires.

At least, with over 100 auctions a year, I am happy to see that Spink is playing its role in reducing the number of non-essential catalogues, saving trees in the process. Our view is simple; when a catalogue will be kept by collectors, as it is a reference collection or a curated sale with amazing items, we do not hesitate to print a catalogue. On the contrary when it is a general sale where collectors tear out the few relevant pages, we don’t think it makes sense to print, and we have a paperless catalogue online. It might be counterintuitive, but sale after sale, we have noticed that many lots achieve a better price in an online sale, compared to a traditional rostrum auction. The main rationale being that bidders have more time (and hence do some research) to decide if they want to bid higher, as opposed to twenty seconds or so in a typical rostrum auction.

A strong first half of the year

Coins – Spring and early summer marked a golden quarter for Spink’s coin department in London, with three landmark auctions exceeding expectations, attracting hundreds of bidders, and firmly cementing our position at the forefront of the global numismatic market. The season opened with an online Ancient Coin sale that reached a 97% selling rate, nearly doubling low estimate with 250 bidders fighting it out for excellent material across the Greek and Roman world, much of which boasted prime pedigree. A week later, the John Noel Simpson Collection of Hiberno-Norse and Irish Coinage achieved a 99.7% selling rate and 246% above low estimate, surpassing all expectations and marking Spink’s most significant Irish coin auction since the Lucien Lariviere Collection in 2006.

In April, our Coins room sale brought forward a dynamic offering of British and World coins, headlined by the first instalment of the Heron Collection of English Silver Coins. The auction comfortably hit its stride, achieving a total of £612,500. A particularly memorable moment came with Lot 256, the Wealden Ring, a Tudor-period masterpiece discovered by a metal detectorist, which soared to £49,000, far surpassing its estimate of £10,000-£12,000.

The Heron Collection also performed above expectations, signalling the strong market appetite for fresh, quality material – a trend the department is well poised to continue fulfilling, particularly with their eagerly anticipated Coinex programme where we anticipate proceeds north of £5mn when the hammer falls on the last lot. Key highlights include the phenomenal ‘Pallas’ and ‘Carrington’ Collections of English gold, which have been off market for decades and promise to constitute one of the most significant auctions of English coins ever seen.

Stamps – The first quarter for the Stamp Department has been busy, with a particular focus on British West Indies. Between January and May the Department held auctions of St Vincent from the Vincent Duggleby Collection, British Guiana, Part II from the Simon Greenwood Collections, and Trinidad and Tobago from the Michael Medlicott Collection, selling over 97% of lots offered, proving the strength in depth for these areas.

I am pleased to note also that the ‘green shoots’ visible in the pastures of Great Britain philately 12 months ago have continued to mature with particular interest shown in line engraved proofs and essays, 1d red usages and Mulreadys. We were proud earlier this quarter to complete the private sales of the famous Plate 77 on piece, and the unique Plate XI block on cover which goes further to demonstrate the increasing strength in this market. I can also report that we have just received the mandate to sell two major Philatelic estates during 2025/26 and details of these two highly important collections I should be able to share with you in the coming months. All very exciting!

Looking forward, we have a busy schedule of auctions following, and viewable at, Stampex (22nd-25th October) including The Tom Gosse Collection of Japanese Occupation – perhaps the best collection ever formed of this popular area; Tibet – The ‘Bramley’ Collection, Part 1 with a number of Dalai Lama letters; Stamps and Covers of Africa featuring the ‘Protea’ Collection of South Africa – a remarkable collection covering essays, proofs and issued rarities; and Stamps and Cover of Great Britain with strong postal history. Prior to Stampex we will hold the next part of the ‘KMC’ Collection of Mexico, and there will be a further two ‘Lionheart’ auctions before the end of the year.

Banknotes – As July drew to a close we saw two auctions achieve strong results across the board, with some thrilling, unexpected bidding along the way. A Government of India, 1000 Rupees, Bombay, ND (1928), realised a staggering £26,000, with a Southern Rhodesia, British Administration, £10 note issued Salisbury, 10th March 1954 realising also very healthy £26,000. Coming up we have a selection of Banknote sales and e-Auctions across the board – please see Forthcoming Sales for further details.

Medals – our sale in July was another great success with a 98% selling rate and a whopping £444,500 achieved for a remarkable WW2 Victoria Cross, as well as a terrific RAF group of seven reaching £88,900, alongside a series of Iraqi orders and medals which shot well above their estimates. Following on from this we look forward to our September online sale, followed by a rostrum sale taking place in early November.

An even busier second half already lined up for you

Coin highlights to come over the autumn include the sale of King William’s watch (please see our special feature), British Coins and Medals Featuring The ‘Pallas’ and ‘Carrington’ Collections (star Lots from which are featured on the cover of this issue), World Coins and Medals Featuring the Hurter-Amman Collection and the Nicholas Rhodes Collection of Nepalese Coins Part II.

In this edition we also have a wide variety of interesting articles including a fascinating feature on Carolingian Coinage, a peek behind the scenes of Hampton Court Palace’s magnificent gardens, and a feature exploring the lives and legacies of enslaved workers who powered 19th century postal ships, plus of course our usual offering of sale-related and other articles to interest readers across all categories.

Our market view

We are one of the few collectables auction houses operating in many different markets and this provides us with a unique vantage point, and it is interesting to see that the situation is broadly similar across markets (though of course there are notable exceptions in sub-segments): we have recouped in most markets over half of the post-Covid boom correction. I have always stayed quite positive in this forum on the state of the market, even when the outlook was gloomy, focusing on the faint signal and the green shoots appearing here and there, mainly based on my views that the “silver revolution” and the return of the Chinese buyers were two engines too strong to ignore. If the “silver revolution” is a long term mega trend, the Chinese economic recovery, a medium term trend, has been scrutinised in these pages on many occasions. The stock market usually anticipates the real economy by six months or so, and this week, after two failed rally attempts in 2023 and 2024, we have seen the Shanghai stock market index reaching a ten year high. If this rally does not peter out, it bodes well for liquidity returning to the global collectables market.

In the last six months or so, most markets have been plateauing, trying to figure out which way they wanted to go. Surely the US tariffs and their possible implications have had a major impact on that “wait and see” attitude? The end result is, as widely expected, in the 15-20% range for most nations, with the notable exceptions of the UK at 10% and Switzerland at 39%, to name just two major markets.

Now it seems that the world is worried by stubbornly high inflation in most places including the UK, or fear that import tariffs in the US will bring inflation higher in the US, combined with interest rates which have to come down from still relatively high levels despite uninspiring economic growth. I don’t need to remind you that high inflation and declining/low interest rates is the perfect combination for collectables, like dry weather and wind for the wildfire aforementioned.

So now is the time to be the most positive since the Covid boom in collectables.

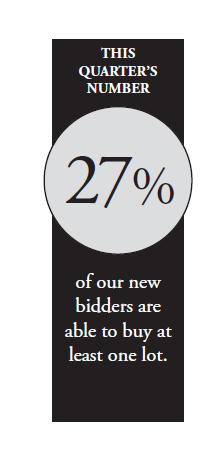

I also draw a lot of confidence from the fact that we are seeing more new bidders than ever before. On average, across categories, the number of new bidders in each auction is just under 10%, which is a high number especially for a company who has been in existence for 360 years and hence with a very large collectors’ footprint. Incidentally these new bidders that we warmly welcome to our auctions, have a success rate of only 27% in acquiring at least one lot, showing that it is tough to compete with the experience of seasoned bidders! They tend to bid conservatively in their first auction as they learn that for rare items you often have to forget estimates, which we try to keep conservative at Spink.

Also, our private Treaty sales have been probably seeing one of their strongest years ever, where we have moved major items discreetly for the benefit of our clients. If you want to sell some important items or collections quickly and discreetly, please never hesitate to contact us.

And when dealers sometime complain to me about bad markets, or bad auctions having a negative impact on sentiment, I always reply that there are no bad auctions, just auctions with uninspiring and non-fresh material. At this stage of the auction cycle unexciting material will always produce unexciting auctions, and we are so proud at Spink to have so much extraordinary material coming up in the next year.

Projects at Spink

We have started a series of great podcasts on various themes relevant to collectors to broaden the reach of our hobbies. The first instalments reached your inboxes in mid-August. If you like the format, please do not hesitate to subscribe in your podcast app to Spink Insider episodes, so you’ll never miss one. And if you wish to be interviewed on a topic do please mention it to us.

We are also investing heavily in a state-of-theart auction management system which should improve further all your interactions with us, every step of the way.

Last but not least, we are preparing the celebrations for our 360th anniversary in 2026. It will start on December 9th with a remarkable auction across categories covered by Spink with 66 exceptional objects, including for example the largest block of 1840 penny blacks in private hands. All these lots are expected to start at very attractive levels closely related to Spink’s long history (£1,666 for the penny black block mentioned above for example, £360, £69 …) to

attract a record number of bids from everybody, including collectors of other areas and new bidders. Trust me, this a catalogue you will want to receive as most, if not all lots will be unreserved.

Our great staff and I are very excited about our collective future.

Wishing us all a lot of fun in the next few months and hoping to see many of you soon in London, Hong Kong or in your place of residence.

Yours truly,

Olivier D. Stocker, CFA, FRPSL

Chairman and CEO