Dear Clients and Friends,

As the nights begin to draw out and a feeling of Spring is in the air, it seems fair to reflect that despite current tragic events in the Ukraine a sense of optimism abounds, as life for most of us is finally returning to normal. Indeed, we could hardly have had a better start to 2022, with no less than 25 auctions held worldwide in January across all Spink locations. That was a huge test to the system and I must say we passed it with flying colours. My most sincere thanks to the staff for delivering such an amazing offering. To all specialists of course, but dare I say even more, to all our exceptional support staff at Spink who more than delivered.

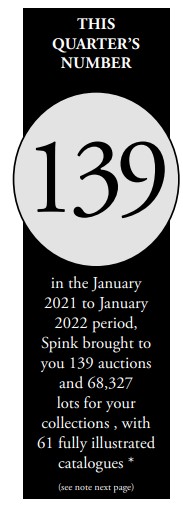

Indeed, for years when in meetings with clients or stakeholders presenting Spink’s activity, I always mention that Spink does “approximately 80 auctions a year” across all our global locations. In a recent meeting with a client, my COO corrected me and said that in the January to January period we had done 139 auctions (see Number of the Quarter below). Being so involved with the business and our numerous new projects, I had not fully realised that we had grown so much. Of course I could not mention January without referring to the stunning result achieved at auction by the sale of the Henry III gold penny, a world record for a single coin found in British soil. Realising £648,000, it is the most expensive English medieval coin ever sold at auction and the most expensive coin ever found in British soil. The same day saw another first for us, the sale of the first numismatic NFT coin to be offered by an international auction house, sold for £18,000 – with proceeds being split over charities chosen by the vendor and Spink (specifically The Rodney Cook Memorial Fund and the Himal Foundation).

The concept of NFTs (Non Fungible Tokens) is very relevant for collectables. They are based on the crypto chain, where all information and contracts are recorded in perpetuity and cannot be altered. The market for NFTs is quite wild at the moment, but it has already become too big to ignore. Estimates put the NFT market size in 2021 at US$20bn to US$40bn. By comparison the total art market is estimated to be around US$50bn annually. I believe, for collectables, there are highly attractive NFTs, whilst the majority might not be so attractive. And I am not judging the underlying digital art or image, just the strength of the contract registered on the block chain and confirming the rights conferred to the NFT owner. A fascinating topic indeed, but for another issue of the Insider. A brief selection of other auction highlights included the superb CB, Indian Mutiny VC group of three awarded to General J Blair, 2nd Bombay Light Cavalry, which realised £216,000; an iconic set of rare Zanzibar currency notes which broke four world records, sold at Spink USA for US$852,000; a world record for a Chinese postal stationery card used in Tibet (less than 12 recorded), sold by Spink China for $576,000; and a Hupeh Province, silver 1 tael, Da Qing Yinbi, Year 30 of Guangxu (1904) which realised $2,580,000. All prices include buyer’s premium.

London 2022 International Stamp Exhibition – back to meeting with our overseas clients once again

February saw our headline sponsorship of London 2022 at the Business Design Centre, delayed from 2020 due to the pandemic – the first such show for 12 years – and it was a source of great joy to see so many of our clients in person again under one roof. Spink hosted a variety of talks and events both at the Design Centre and in-house, and we were delighted to welcome so many old friends to our evening reception in the Spink Gallery. We were delighted to be a key supporter of this first great international show post pandemic. I also had the honour to toast the President of the Royal Philatelic Society of London ((RPSL), Peter Cockburn, at the Guildhall black tie dinner.

A word on the markets: Covid vs Inflation

I have been writing for a while that after an extraordinary two years for the markets, their future rise will be driven by two main engines. First, the ‘stay-at-home engine’ which has forced many existing collectors to spend more time with their collections, and to spend more on them as their disposable income could not be spent on many other things. It also brought many past collectors back to their albums, or cabinets, to venture again into the wonderful world of collecting.

But the other engine, the ‘inflation engine’ is now in full throttle after a few months of roaring, and affecting mainly business through increase in raw materials and logistics. The Ukrainian crisis, beyond the human tragedy, has accelerated all pre-existing issues and put the inflation at every household’s doorstep. In some areas (energy, raw materials …) the price swings are so vast and sudden, that a new term has been coined by economists: whackflation.

It is a global phenomenon and all, to various degrees, are affected. In the Euro-zone, for example, in March 2022 inflation was at a whopping 7.5%. It is fair to assume that inflation will sadly be upon us for a while, and that it will drive collectable prices higher as we see people taking refuge in tangible assets to protect their liquidities against inflation. Also, we start to hear that with the “weaponisation” of currencies during the current Ukraine crisis, investors – or the average homo economicus – are looking for alternative investments. Equities had a huge run and are subject to wild correction as seen in the first quarter. Bonds look like they will fall to deliver the expected interest rises necessary to combat inflation. Many are long property. Inflation is good there, but rising interest rates not so much. So cryptos are back in play, but they still worry a lot of people especially in our generation of conservative core collectors. Gold has had decent return, but nothing fantastic. So where to park one’s extra cash? Collectables continue to be one of the best areas after all. And they provide so much enjoyment to us. I have personally put my money where my mouth is and bought quite a few collectables, starting new collections during the Covid crisis.

So yes, I am still positive on the outlook for collectables in general, even if some areas which have gone up a lot in the last decade or so might need to take a breather.

What’s New for 2022?

We saw 2021 out in style, launching our new whisky cask collaboration with Cask 88 – one of several new initiatives in the pipeline. Our new Private Treaty online platform is up and running (visit www.shop.spink.com), bringing you unique stamp, coin, banknote, investment gold and other specialist offerings from around the world at fixed prices, allowing you to add to your collection at any time. We are also proud to have announced a long-term collaboration with the artist Ann Carrington, some of whose unique and eye-catching pieces you can see on display in the Spink Gallery. You will no doubt recall that Ann created the banner for the Royal Barge during the Queen’s Golden Jubilee celebrations in 2012, and limited edition prints of Ann’s work will be featured in a special Jubilee collection of art throughout the InterContinental London Park Lane – the site of the house where the young Princess Elizabeth lived.

Talking of the Jubilee, our author Philip Attwood will be curating an official exhibition of work by the artist Mary Gillick, who designed the effigy of Elizabeth II used on coinage in the United Kingdom and elsewhere from 1953 to 1970, to be held at the British Museum at part of the official celebrations. Spink Books are delighted to announce the publication of Mary Gillick: Sculptor and Medallist by Philip to coincide with the opening of the exhibition – books can, as always, be purchased via the Spink Books website, www.spinkbooks.com.

Do look out for us at the many shows we will be attending over the next five months, from the Paper Money Fair at Valkenburg (April) and the Porto International Numismatic Fair (May) to the London Coin Fair and the York Stamp and Coin Fair. As always, free valuations will be offered on our regular advisory days – and do also keep an eye out for an exciting new initiative, to be announced at the Rodney Cook Memorial rally at the beginning of September.

The Rodney Cook Foundation does a huge amount for cancer victims. I am sad to say we lost two of our great friends and philatelists this quarter. First, on 6th January, David Parsons and on 1st April, Frank Walton. All our thoughts are with their families. The hobby will thoroughly miss them for their knowledge, passion and kindness. Stay tuned for more NFTs, more auctions – please see Forthcoming Events for our full offering, including the remarkable Klempka Family Collection of Great Britain to be sold over 2022 and beyond – more events, more fun and more record-breaking prices!

Have a lovely Easter or Passover Break, with lots of family and friends, and hopefully some easy travel